cepAdhoc

Economic & Fiscal Policy

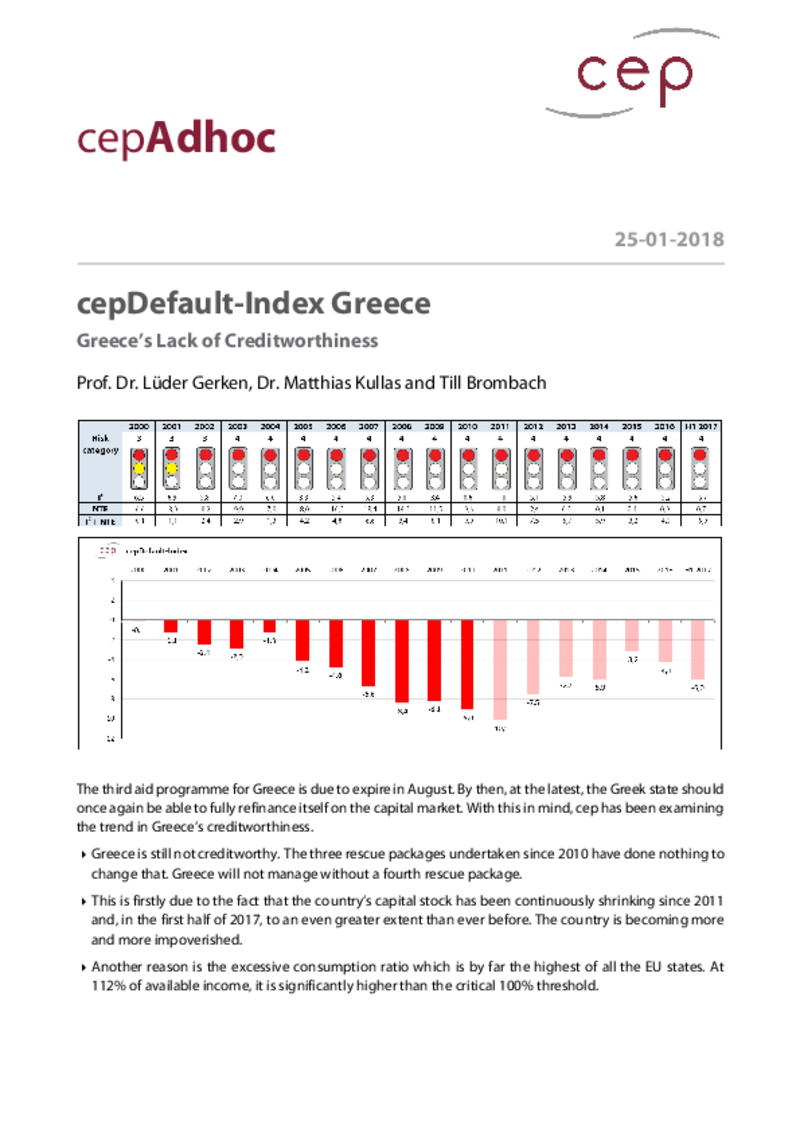

cepDefault-Index Greece and Portugal

cepAdhoc

Portugal's creditworthiness has been deteriorating since 2004. According to cep, this is caused, firstly, by falling capital stock due, in particular, to low public sector investment. Secondly, the country continues to consume beyond its means, although the consumption rate has dropped significantly since its peak in 2009.

In cep’s view, both countries must improve conditions for private investment.