cepStudy

Economic & Fiscal Policy

cepDefault-Index 2018

cepStudy

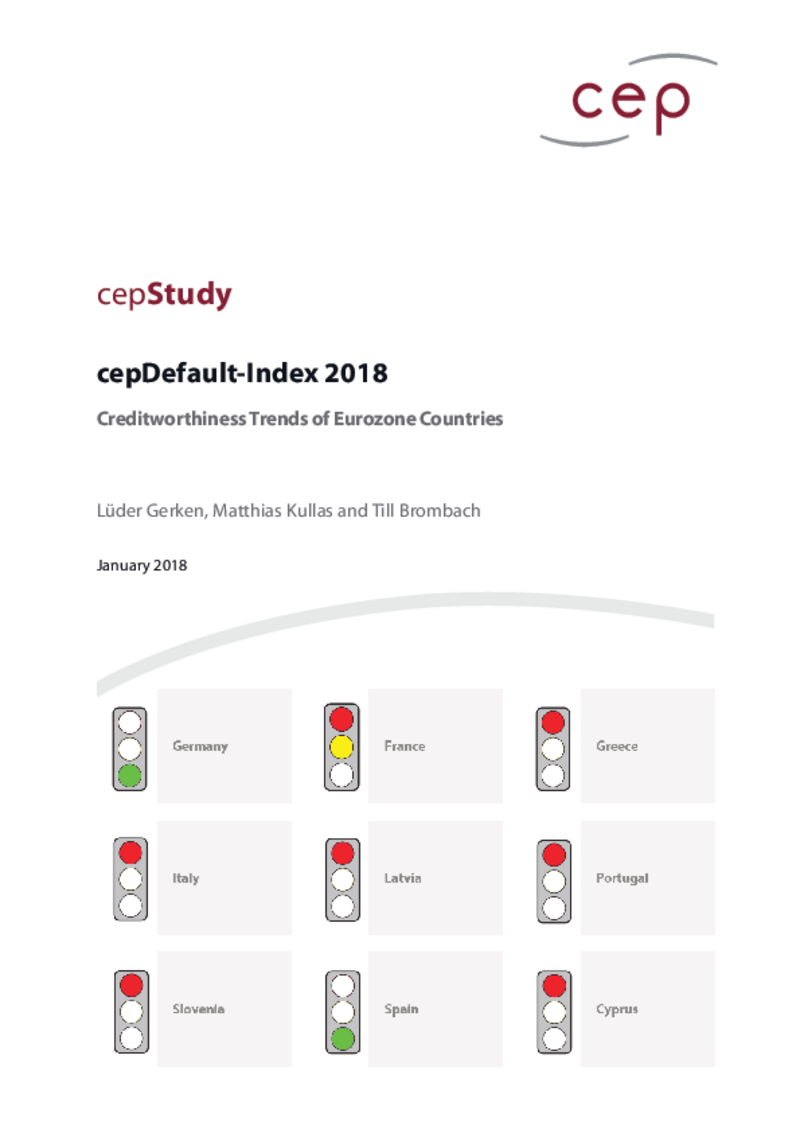

The group of eurozone countries who have long had diminishing or diminished creditworthiness, includes Greece, Italy, Latvia, Portugal, Slovenia and Cyprus. As was already the case in 2014, France also finds itself in the group of countries whose creditworthiness is declining. In cep’s view, the depletion of capital stock in these countries shows that they are unable to offer attractive conditions to potential investors. The first objective of structural reform must therefore be to make these countries more attractive to investors.

Download PDF

| cepDefault-Index 2018 (publ. 01.30.2018) | 2 MB | Download | |

| |||