cepStudy

Economic & Fiscal Policy

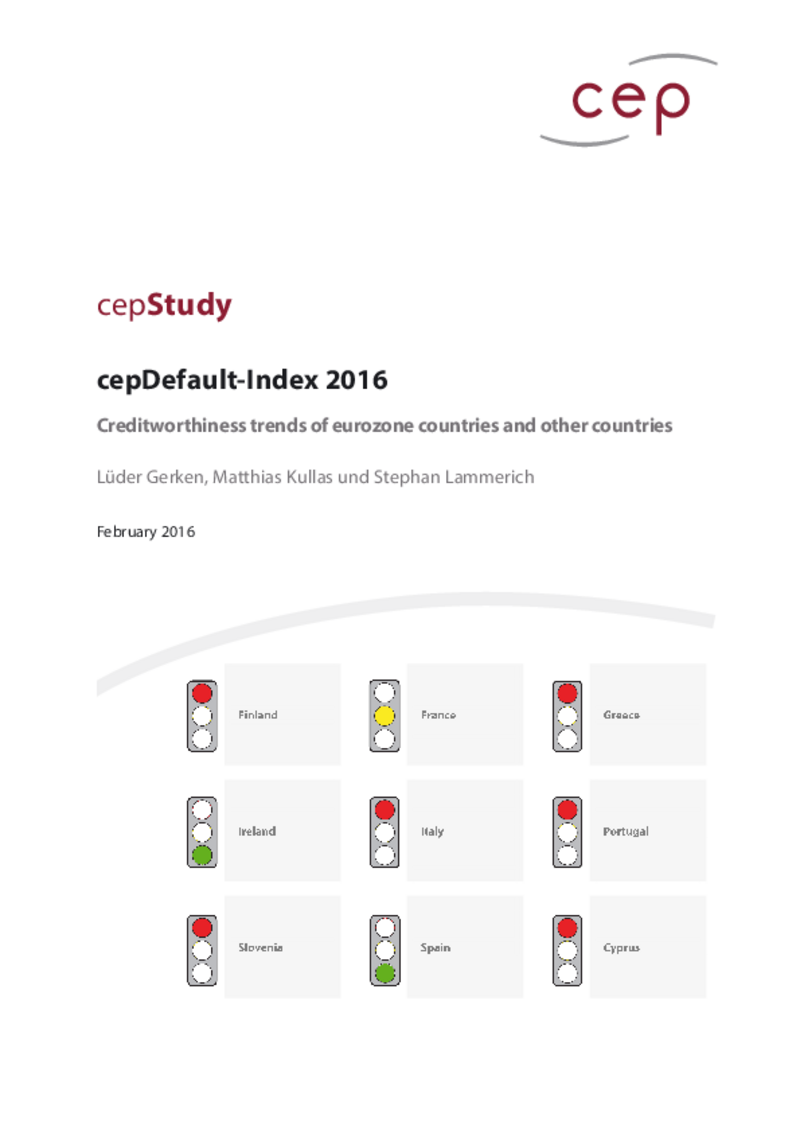

cepDefault-Index 2016

cepStudy

The current period of tranquillity on the government bonds market is thus misleading. It is not the result of a sustained recovery of the eurozone but of intervention by the European Central Bank, which is buying government bonds and thus having a calming effect on capital market players. Measures to permanently stabilise the eurozone therefore remain urgently necessary. Re-establishing the competitiveness of the economies in the problem countries must take priority in this regard.

Download PDF

| cepDefault-Index 2016 (publ. 02.01.2016) | 3 MB | Download | |

| |||